This comprehensive guide explains how to sell a chirpractic practice. We will review the most important things to consider from our experience. Learn how to buy or sell a practice with the free resources on this page, or relax and let us do the work for you by clicking here.

We're just a phone call away

Wherever you’re at, you’re not alone. We’re passionate about helping fellow medical practitioners buy or sell a practice. Reach out now. The first call is free.

Wherever you’re at, you’re not alone. We’re passionate about helping fellow medical practitioners buy or sell a practice. Reach out now. The first call is free.

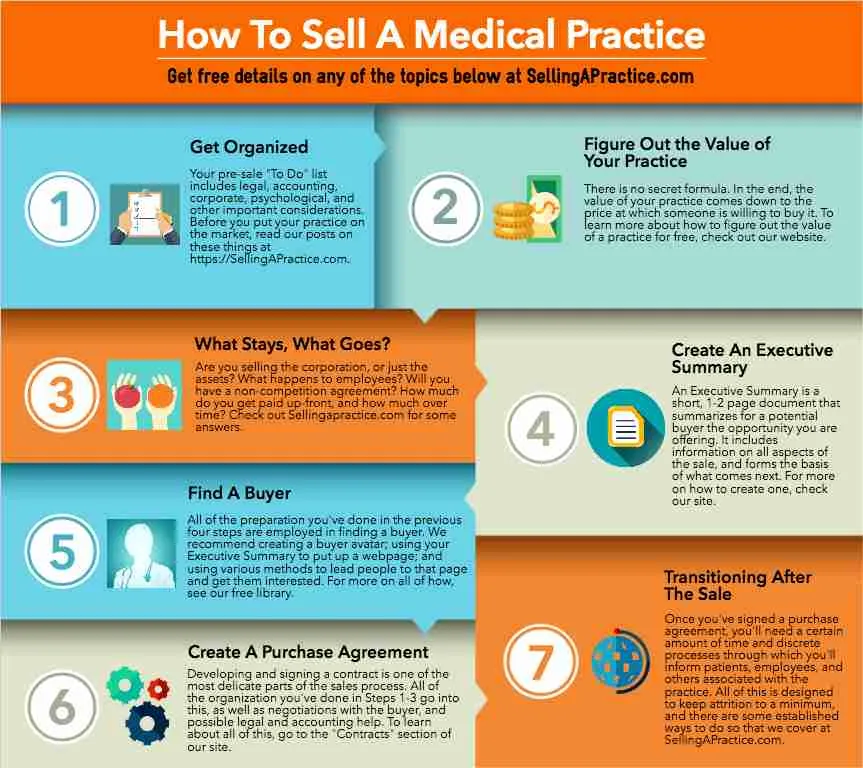

Table Of ContentsA Visual Guide To Selling A Chiropractic Practice

You need to get organized before you can sell your medical practice. Learn what you need to do through our pre-sale checklist, and have the right questions answered before you sell.

Whether you are just considering selling your practice and are curious about what you might need to do, or you are ready to go for it and need to know where to start, you’re in the right place.

There are several ways of looking at how to prepare your chiropractic practice for sale. They can be divided into:

Let's jump into each.

Before and during my time as a newly-minted practitioner, like most of us, I focused exclusively on how to build my practice. I’d think through all the ways I could improve it; all the ways I could build in efficiencies so I could do a better job and make more money while working less. I attended practice management and billing seminars. You know how it is.

But after ten years of a successful practice, I started to realize two things:

You don’t want to keep growing in size and complexity. There also comes a point as a practitioner of diminishing returns: you only have so much time and energy as a practitioner, and as a manager. Along with this.

As that second thought gradually crept into my conscious mind, it scared me. I had no idea what I would do if I wasn’t practicing medicine. But I knew at some point I had to consider it.

As the founder of one of the first practice management software companies, I used to run around the country on weekends not only talking about medical practice software, but also teaching medical practice management to medical students and practitioners. In those classes, I started to ask my students, many of them just on the cusp of starting their own practices:

I was asking as much for myself as I was for them. And I was somewhat surprised to find that 95% of my students had never considered the “after” part.

If you’re still reading this, you are likely smack in the middle of considering the “after,” and chances are that you haven’t thought too far down the line beyond the sale of your practice.

Imagine some of these scenarios, how you might feel and what you might do, if:

These questions should be thought through carefully and discussed with those closest to you. If you and/or your family are of two minds about the answer to any of these questions, we recommend you work though those issues before you endeavor to sell your practice.

Even when everything goes well, your practice sells for an amount you are happy with, and you can move on with your life, many of us have not fully thought out what happens next.

The time to start thinking about this is before you ever start down the road of selling. The time is now.

Before you go too far down the road to selling your practice, consider the following factors and how you may remedy or explain them to a potential buyer. Remember that a buyer will be scanning for any kind of danger to their investment in what would be their new investment, and the following are issues to review:

A buyer of any sophistication will be looking at all of these variables, both tangible and intangible, as they decide if your practice is worth pursuing.

If any of these questions can be answered as “yes” or “maybe,” think of how you’d answer a potential buyer before you even start to search for one.

In our experience, the following are variables that make a practice more attractive and a relatively easy sell:

Having your paperwork in order before you start the process will go a long way to a successful sale.

Of course, this is not an exhaustive list, but these are some of the factors that buyers will find attractive and those which you will want to focus on in the process of finding a buyer for your chiropractic practice.

If you find any of these factors missing or lacking, think about how you can remedy them in advance of even beginning the process of selling your practice.

Having as much of these issues thought through and prepared before you get your first call from a prospective will go a long way to establishing early on that you are a savvy practitioner with a valuable practice—one that a well-qualified buyer will want to know a lot better.

While this post may give you a lot to think about, we’ve also created a free Presale To-Do List that you can download and go through in order to prepare for your sale. It goes through very specific tasks that you should have completed before you even start looking for a buyer. If you’d like to get it, let us know.

In the process of preparing to sell a chiropractic practice, the most important variable, and most valuable asset, is time.

The more time you have to prepare your practice for sale, the more attractive it will appear to a buyer, and the more options you will have for correct marketing to find the perfect buyer.

If you have ever bought something big, like a house or a car, you know how important it is that you check out every possible thing that could go wrong, to be sure you aren’t missing something that could come back to bite you later.

With the complexity of the purchase and sale of a chiropractic practice, the same is true.

So let’s get specific:

If you are preparing to sell your chiropractic practice, what are some of the specific issues you need to address?

First, if you haven’t already, I highly recommend you read our post on “3 things to consider before selling your practice."

Next, let’s consider what buyers want to see.

Consider the following list-- a “To-Do List” of things you need to address to make your practice as attractive as it can be for a buyer. If you're not sure why any one of these items is important, let me assure you that each one has led to the end of a potential sale, or at least a very big bump in the road.

For each item below, decide whether or not it pertains to you, and if it does…ACT!

Note the boring, puke-y colors I used to outline these items. Most people don't consider this stuff very fun. But for many people who are looking to sell their chiropractic practices, this is the hardest part. Once you've addressed the items above, you'll have created the necessary momentum to get your practice sold.

Great question! There is a heck of a lot to keep track of when preparing to sell your chiropractic practice.

For those of you who are not familiar with project management software, its intention is to help teams of any size stay organized and on task. A good project management software package will be shared among several people, and will usually have one person who is more or less in charge of assigning tasks and checking them off as completed over time. When used correctly, most of the tasks remaining in your transition will be organized from within the software, down to texts, emails, and related documents that can all be shared. Think of it as an ongoing conversation between one another related to specific tasks.

We have a whole post on this subject. So, if you're interested in learning more about how to stay organized with project management software, click here.

There are undoubtedly more items that you could add to this list. However, these are the things that we most often see overlooked before a practice goes up for sale. Having most or all of the items above dealt with before you even look for a buyer will go a long way to not only finding a buyer, but easing your mind about what comes next.

Once you have these tasks under control, check out our posts on how to find a buyer, as well as the five steps to take before your first buyer call. You’ll find it all at https://www.sellingapractice.com.

If you’ve already got all your ducks in a row and are ready to look for a buyer, click here to learn how to do it.

And if you need any help with any of this, contact us. We're always happy to help!

Imagine that you want to sell your practice, and you have a party that is interested in buying it. They want you to send them a document that summarizes everything about your business. It's kind of a business plan, but one in which you are trying to sell the reader on the viability of your practice. In this case, your business plan is to sell the business! This is where the executive summary comes in.

Ultimately, all that you are doing with an executive summary is keeping your potential buyer's attention by leading them through a series of facts that make their decision to buy your practice seem like a very good decision indeed.

To put it in business-speak:

An executive summary, or management summary, is a short document or section of a document, produced for business purposes, that summarizes a longer report or proposal or a group of related reports in such a way that readers can rapidly become acquainted with a large body of material without having to read it all.

It usually contains a brief statement of the problem or proposal covered in the major document(s), background information, concise analysis and main conclusions.

It is intended as an aid to decision-making by managers and has been described as the most important part of a business plan.

By the time many of you are reading this article, you may already have taken advantage of the option of a free call with us. In those calls, for sellers, we often recommend that those who are at the very beginning of the process of selling their practice should write an executive summary.

reating an executive summary has many advantages, not the least of which include:

There is no exact, perfect formula for the way that one puts together an executive summary. That said, there tends to be some common elements to them. Generally speaking, they tend to include the following elements (note: these were sourced from a template you may want to check out from Qlutch):

This is a compelling statement of why your practice is exceptional. Make it concise and concrete. Do not lead with a description or your team or environment. Buyers are more concerned about about making safe bets than almost anything else.

Clearly describe the problem that you are going to solve for them. Describe the pain and how you’re going to solve it. Could be how challenging it is to start from scratch, how long it takes to start a practice and organize it.

Introduce your practice as the solution here. Use straightforward language and describe exactly what you have and how it solves the problem you have identified above. This could be how consistently you’ve been successful, and other language that assures them that your practice would be easy to take over and profit from.

Describe the market here – the size, lifecycle and dynamics of your patient population and referral sources. How fast is it growing? What’s driving growth? Are there other ways to grow that you haven’t adopted yet, but the buyer could? Be specific.

Do you own any intellectual property? A patent? Exclusive distribution of some product? Clearly describe what makes your practice unique.

Describe your revenue here. What are your monthly grosses and costs (on average, over the past 12 months)? It’s best if these are predictable, repeatable costs that any new person would take on, such as monthly rent, utilities, employee costs, cost of goods sold, etc. No need to include anything here other the essentials that the new buyer would have to take over to succeed as you have.

You’re selling an investment opportunity, so use your financial projections to quantify what success you expect to show. Your projections should be defendable. Be wary of general hockey stick curves; you will lose credibility if they’re not believable. At the minimum, include a year or two of annual projections for revenue, expenses, net income or loss, based on the average of your last five years.

How much are you asking for? Don’t ask for too little – a good buyer will expect that you’ll be willing to negotiate whatever you list here.

While all of the above elements need to be in an executive summary in some fashion, they don't have to be formally divided up as they are above. Basically, as long as those elements are contained in the document in one or two pages, you've got your executive summary.

To make an executive summary specific to a medical practice, be sure it contains:

You could make a run at doing your own executive summary using the information above, do some Googling around to find some templates, and/or ask us for some help.

We can even do all of the work for you, if you'd like. That's part of what we are here for. Give us a call, let us ask you if you simple questions, and we can whip one of these guys out for you in no time flat! Contact us now.

The true value of a practice isn't a simple formula; rather, it's what a buyer is willing to pay. Learn about the different standards of valuing a practice and how to set the right price.

Before we get too mired in the details of practice valuation, I want you to do something, real quick.

If you're considering selling your practice:

Off the top of your head, what do you feel your practice is worth? What do you think you deserve?

If you’re considering buying a practice:

Knowing what you know, what does your gut say the practice is worth? Not “how much can I afford,” but how much do you believe it is worth?

Keep those numbers handy as you read through this article.

In the process of researching medical practice valuation, you are likely to find that there are a number of “experts” out there who will tell you that they have a formula they use related to your income and expenses, and they may try to make the process opaque.

They’ll tell you that they have special certifications and patented methods that they would be happy to reveal and print up and put in a binder with your picture on it after you pay them a retainer.

But let’s get right to the truth of the matter:

The true value of a practice is not the amount you think it is worth, nor the amount someone tells you it’s worth based on gross, net, multipliers and the like. Rather, it's how much someone is willing to pay.

There are many methods to consider in fleshing out the value of your practice. Some of the most common include:

Years ago, I ran and later sold one of the first medical billing and practice management software companies. At the time of the sale, there was this idea that one could value a company at anywhere from 1.5 to 3x the gross annual revenue of the business. And that’s what we did. That 1.5-3x is the multiplier.

When it comes to medical practices, ten or fifteen years ago, the “rule of thumb” was that the value of a practice was 1.5-2 x revenues. But, given large-scale changes in healthcare, medical billing, back office costs, more physicians working in groups rather than solo practices, and a host of other causes, most practices tend to be sold for a price at or below their annual revenues.

This is a lot like the way a house is sold: You compare your practice to what other similar practices in your area and of a similar size have sold for. You find “comparables” (comps). The thing is, there is no generally recognized source of medical practice comps. The exception to this is where selling a building is concerned.

When selling a practice along with ownership of the office itself, we have very specific ways of valuing each, together and separately, and we’d be happy to discuss these methods with you.

sectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip commodo consequat.

The income approach values the business based on the underlying asset plus the income it produces after expenses. So, using a house as an example, if you owned a house worth $100,000, but it rented at $5,000/mo, the asset (the house) is worth more than its base value of $100,000 because it also generates $5,000 per month.

The higher the income stream, the more valuable the house becomes, and future earning potential (which really is goodwill) becomes part of the equation for valuing it.

While this seems an obvious, positive approach, in reality, it usually doesn’t pencil out for medical practices, as the income from a practice is produced only at the time the practitioner performs the service, and is usually taken home as “profit” as soon as it’s paid. There is no additional, residual, passive income generation from most medical practices.

This is the tact we most often prefer to take. It allows asset classes (tangible, intangible, goodwill) to be clearly separated out and assessed, and it also helps in the final accounting come tax time, as buyer and seller can divide up what assets are taxed in the manner they choose.

More formally, this breaks down into the following subjects to consider in an evaluation of the practice’s selling price. How much are the following worth?

This is the stuff in the office. The furniture, fixtures, medical equipment. Even the decorations, books, chairs in the waiting room. Whatever objects and equipment the seller intends to let go as part of the sale. As a seller, you would quite literally go through the whole office(s) and itemize everything.

When I sold my practice, I was advised by my accountant to price each asset as if I would be selling it in a garage sale, not so much based on “what I thought it was worth.”)

The itemization of assets has a significant tax implications. See our post on the tax implications of the sale of a medical practice, and definitely talk to your CPA for more advice.

How much does the practice bring in before expenses? For this number, most buyers will want to see consistency of both revenue and accounts receivable.

Revenue is the amount of money that a company actually receives during a specific period, including discounts and deductions for returned merchandise. It is the "top line" or "gross income" figure from which costs are subtracted to determine net income.

This is basically the business’s profit, the amount left over when you subtract expenses and operating costs from revenue.

How you show expenses is a subject that gets a lot of attention. Assuming you are using some kind of finance software such as Quickbooks or somesuch, you should be able to generate a profit and loss / income vs. expense report. Better still if you can do this for the past several years. This way, a potential buyer can see the consistency of expenses and income.

The thing is, many of us have expenses that a buyer may not be inheriting, such as certain staff, equipment expenses, and stuff like continuing education that is put against the revenue for the purpose of reducing one’s tax burden.

What’s more, the numbers on one’s tax return may not match up with the profit and loss statement. And, while we expressly do not advocate this, there are some businesses that do not report cash payments from patients. This presents complications as, in the end.

A seller will want to show maximum net income (profit after expenses) and minimum expenses.

Thus, you may need to set up an Adjusted Profit and Loss statement for a potential buyer that shows expenses they would be inheriting, leaving out the expenses they would not need to keep in order to keep the business humming along.

Dealing with these kinds of complications is what our consulting arm specializes in. If you’re wondering how to rectify differences between your tax returns and profit and loss statements, give us a free call.

As one popular finance website puts it,

The value of a company’s brand name, solid customer base, good customer relations, good employee relations and any patents or proprietary technology represent goodwill.

To further clarify, I’d add to this definition:

Think about the goodwill of Nike. It’s been around for decades, has a reputation for its technology and functionality where athletic clothing is concerned, a huge number of trained employees around the world, and a logo that most people recognize without needing to even see the word “Nike.” This is all goodwill.

Now imagine that someone wants to create a new brand of athletic clothing to compete with Nike. They won’t just be competing on the quality of their clothing; the hardest part may be going up against the goodwill of Nike. And if they wanted to buy Nike, the whole company, the value of Nike’s goodwill would represent much more than their tangible assets—it would have to include the company’s goodwill.

When Facebook first started getting popular, Yahoo, Viacom and others offered well over $1 billion for it long before it started to be a profitable company.

As we now know, those offers were turned down. At the time of this writing, Facebook is said to be worth half a trillion dollars. Too high a valuation for anyone to afford!

So while you may not be selling a practice that equates with the goodwill of a Nike or Facebook, you will need to be careful that you don’t price your goodwill (and practice) higher than the market could possibly bear.

Given that goodwill is intangible (not a real thing you can objectively see or touch), it is often the part of the valuation equation that is most difficult to calculate. That said, with the sale of a medical practice, in the final analysis, it often accounts for the largest amount of the value of the business.

Goodwill only exists and is determined when a business and/or its stock is being considered for sale. Otherwise, it doesn’t really exist.

These days, our experience is that buyers are paying less for goodwill and basing most of the value of the practice on past numbers and the perception of being able to continue or increase profit.

We have also found that, the way to give a buyer the greatest confidence that they will be able to replicate the seller’s success (and retain its goodwill) is to put incentives in place to minimize attrition, as well as show that the practice can make even more through a few simple tweaks.

You may also want to check out our articles on transitioning a medical practice from one owner to another for some examples of how to do it.

Regardless of how or how much you calculate your business to be worth, the state of the economy will impact your final price and how easy it is to sell. I don’t think I need to go into too much detail about why—quite obvious, this one.

The terms of payment you are willing to agree to as a buyer or seller will certainly have an impact on the final price. While the dream is to have your asking price paid in cash upfront, the reality in most cases is that it will be partially or wholly financed.

The terms of the financing may help determine the price, as a motivated seller may agree to a discount in exchange for more cash at the time the sales contract is signed, or for a year or two of monthly payments instead of four or five years.

As a seller, paying in installments may also benefit you from a tax perspective. And as a buyer, interest on a loan may also be a write-off. More on taxes below.

The way you justify your price will usually break down into the asset classes listed above, and the IRS has different ways of handling each. The amounts allocated to tangible assets, goodwill, and even a non-compete can all significantly impact the amount left in your pocket when all is said and done.

For instance, in an asset sale, a buyer will usually want to max out on tangible assets they are buying as a percentage of the total value of a practice for tax reasons, whereas a seller will want to put more weight into goodwill. We talk more about this in a special post weighing the benefits of an asset sale versus an entity sale, here.

I won’t go into great detail on the reasons why here, as I am not a tax professional. So when you get serious, find a good one. (If you need help, let us know.)

The way a sale is timed can have a major impact on its valuation and final sale price.

We recently helped a woman sell her acupuncture practice for about 1/10 of our assessment of its value due to her personal situation. While the business had been doing well for several years, her husband had just been informed that he was being transferred to another location in 6 weeks. She and her family had to relocate in that time span, and thus needed to sell as quickly as possible for whatever she could get. She was thankful to find a buyer at all, given the circumstances.

In another case, a large and very profitable complementary medical practice in the Bay Area suddenly had to shudder its doors when its owner and lead practitioner took ill and died three weeks after his diagnosis. His wife has been left to pick up the pieces, selling off each part of the practice as she was able.

While the above stories are extremes, the bottom line is that, the longer you have to prepare your practice for sale without a hard deadline, the more likely you are to get close to your ideal asking price.

We are aware of many unique ways of preparing a practice for sale, and would be happy to help! You can also check out a post or two on it here.

Think about selling something simple, like a bike. I recently had one on Craigslist. I had bought it for about $800, and a year later, after not having ridden it much, I tried to sell it for $599. And then $450.

Craigslist shoppers can be a haughty bunch, and I was immediately assuaged by people telling me it was overpriced. So I had to keep lowering the price until someone would take if off my hands ($300, if you’re curious. Ouch.).

Of course, selling a medical practice is a much more complicated proposition, and there’s a lot more at stake.

Unlike an object on Craigslist, if a practice is overpriced, a seller will not necessarily be able to keep lowering the price until it sells.

Many professional appraisers like to compare themselves to appraisers of houses, so let’s use that as a more a propos example.

Much like a house, once you set your desired price, the marketing begins. Someone looking for a house like yours will see it when it gets listed, and their curiosity will extend only as far as their ability to afford it, and perhaps even more importantly, their feeling that it is worth the amount being asked for it.

Anyone who has bought a home knows that, when you see a home advertised that appears to be what you’re looking for, but has been on the market a long time and the price keeps going down… you’ll think something must be wrong with it.

As a buyer, you’ll either stay away from it, or lowball the hell out of it on the assumption that, by now, the seller must be desperate to sell.

At the beginning of this post, I asked that you pick a number quickly off the top of your head for what you feel the practice you are considering buying or selling is worth. Return to that number now that you have read this far.

How does that number look and feel now? Still seem reasonable? Has it changed at all in light of the information you have taken in?

In the end, there are many ways to determine the value of a medical practice, and however complicated the analyses may appear, they usually boil down to the most important things that any buyer will be considering:

A buyer wants to be sure that a practice has a steady income, is profitable, and has a great reputation.

Even more fundamentally: That in purchasing the practice, they will make money, and have the opportunity to continue to do so.

Price your practice in a way that it will lead to a sale, based on defensible assumptions. After all the work you’ve put into preparing your practice for sale, all the stress of talking to the relevant stakeholders, and planning your post-practice life, it could all be for naught if you stumble on this first, critical step.

If you have questions about how to do this or want some assistance figuring out what a practice is worth, we’re here to help. Reach out and let us know where you’re at, and we’ll be happy to share our knowledge with you.

Simply listing your practice for sale on a website doesn't get you a buyer. Learn the dos and don'ts of and some unique methods to find that needle in the haystack, the perfect person to take over.

When I used to run my own practice, after years of trying to find the right way to market our services, I found that the most effective method was to tell other allied physicians and practitioners that we specialize in people who are hard to treat. That we want the people who have already tried everything else first. We want the most “difficult”patients.

Many doctors, physical therapists, chiropractors and the like would ask why we would want the patients they least enjoyed seeing, patients who had not responded well to other modalities or who just did a heck of a lot of complaining.

The physician had a new idea for what to do for their patient, and was happy to refer them out with a new plan;

The patient usually was at their wit’s end and didn’t think anything would work for them; and,

Worst-case scenario, we met the patient’s expectations. Doing any better than their low expectation would be considered a significant win for all involved.

Why do I bring up this story in a post about finding a buyer?

Because most of the people who call us to help them find a buyer have already tried doing it themselves, using a broker, or have almost had a sale and it fell through. It feels very familiar.

The number one reason we hear from people who want to sell their medical practice is because they want help finding a buyer, and we love to help those who have tried everything else first.

Why is it that so many people have a hard time finding a good buyer for their medical practice and consummating the sale?

In our experience, it comes down to two factors:

Of those two factors, the second one is that which will be covered in this post.

But first, a note about being properly prepared to sell.

Before you even consider looking for a buyer, you need to have prepared your business to sell.

This post focuses on finding a buyer, so rather than going into all the details here on the essential steps to prepare your practice for sale, we want to direct you to check out the following free resources here on our website:

Once you have gone through these resources and done the stuff recommended therein, only then are you ready to move forward and begin looking for a buyer.

Anyone with any experience selling a chiropractic practice will tell you that they have proven ways to find buyers. The most common include:

Many of those we work with have already tried these methods before contacting us, and found them ineffective.

For our part, we have rarely found any of these methods effective either!

Thus, we recommend that, if you are looking at hiring someone to help you sell your practice, ask him or her what methods they employ to find a buyer. If it starts and ends with the list above. good luck.

We prefer other methods.

What we have found most effective in selling a chiropractic practice is to get properly organized; create a business summary; create a “buyer avatar”; design a hidden web subdomain (yes, hidden); and do a demographically-targeted direct mail and/or email campaign. All of these need to happen in a specific order.

Let’s get into more detail below:

It may seem I am repeating myself, but I cannot emphasize this enough. Before you look for a buyer, you need to get organized and make some decisions, including:

Follow some of the links herein or contact us for more information on how to get organized.

An Executive Summary is a short (1-2 page) document that is typically created for the purpose of selling a business. It is a concise statement about the what, why, when, and how of your sale and the assets that you are selling. (We thought it was important enough to write a whole post on it, here.)

Creating this document can be challenging, because it forces you to think like a buyer. You will need to have your numbers ready, including the amount that you want to receive for your practice. It talks about why your chiropractic practice is a good deal to buy; it justifies why you priced it as you did; and also tells the buyer about the kind of rosy future they could have if they were to buy it.

Aside from organizing the key selling points of your practice, the Executive Summary can be repeatedly repurposed for the advertising you will be doing. It gives you something that you may easily email or mail out when an interested buyer wants to know more about your practice.

We have a more detailed post on what goes into an Executive Summary in this post. We are also frequently asked to write them for our clients. Reach out to us if you’d like some help with yours.

Once you have your Executive Summary, you should.

Put simply, you want to take a moment to think about what the ideal buyer of your chiropractic practice looks like. You want to flesh this out as completely as possible.

This may seem like a silly exercise, but it is absolutely essential, as it will save you countless hours and a ton of money by allowing you to demographically focus your marketing.

The essential elements that go into thinking about the perfect buyer include:

This process is used every day by the best marketing people in the world. They will build not just one, but several customer avatars, and then focus their marketing accordingly.

If you Google “customer avatar”, you will find plenty more on this topic, as well as many worksheets that you can use to create your own avatars.

One example may be found here at Digital Marketer.com, but there are many, many more online.

Once you have a sense of your ideal buyer, the next thing we usually do is:

A domain is just the location of your website, a web address like https://www.sellingapractice.com.

A subdomain is another location on that site, which may look like this: http://buyme.sellingapractice.com. The bold, underlined part is the subdomain, and it is just a webpage you create which is found at that subdomain address.

The reason we call it a “hidden” subdomain is that we often put it up under your own domain (your clinic’s website), and only those who know the subdomain address will know that it even exists. (Otherwise, you may unwittingly be revealing to patients and others that your practice is for sale.)

What goes on that subdomain page? Your Executive Summary. You can pour that info into the webpage to which you can direct interested parties, and have a Contact section so that potential buyers can find you.

(We design and install these subdomains all the time, and would be happy to do the same for you.)

So why do you need a subdomain with what amounts to your executive summary on a hidden page? Because you will next direct the right eyeballs to your subdomain.

With the other four steps in place, you can now use pieces of your Executive Summary to create mailers and/or a mass email which directs people to your subdomain, where they can get more extensive information about the sale of your practice.

We also think about what that ideal buyer is looking for and why they might be interested in the opportunity to buy your practice.

For instance, maybe your practice is in a beautiful area in a small town in New Hampshire. You imagine that your ideal buyer might be someone in a big city who vacations in a place like the area where you work. They want to get out of the big city and relax, yet aren’t ready to retire.

So why not work where you vacation? The marketing would target practitioners in New England, perhaps all the way down to New York City, who we feel fit the demographic of your ideal buyer.

Where do these people come from? How do you find them?

You use the information you gathered about the buyer avatar exercise you did to decide who you want to target and how you will find them. Remember the step of figuring out what kinds of magazines or online resources that ideal person would read? That’s one clue.

We also use many other specific ways to target your ideal buyer with direct mail and email. Feel free to contact us for more on that.

Finally, what ties it all together is that, on your direct mail and/or emails, they may go to your subdomain (http://buyme.yourclinicname.com) for more extensive information and methods of contacting you.

Needless to say, there are many other methods of finding a buyer for your chiropractic practice. The above five steps are those we have found get the most immediate and appropriate traction.

Here are a couple of other ideas, which assume that you have, at minimum created an Executive Summary first.

It may just be that your perfect buyer is just down the hall, or around the corner.

If you employ other practitioners or people who already have extensive knowledge of your business, and you trust them, you may wish to broach the subject with them. (Of course, have them sign a non-disclosure first, no matter how much you may trust them!)

Employees are often the easiest, and smoothest transitions out of a practice, and may have already been considering buying or investing in a chiropractic practice of their own.

The last clinic I ran was on “medical row” in a medium-sized San Francisco-area town. We had all kinds of modalities within a block of our office, including several practitioners who did the same work that we did.

Approaching a colleague, someone in the same business who you already know and who may be looking to expand their practice, may be a great option. They may be looking for what you have, and, like selling to an employee, it may save you a lot of time, energy, and money to just take a walk down the street.

A complementary buyer would be someone who has a vision of expanding their business to include yours. For instance, if you have a physical therapy clinic and a busy orthopedic surgeon has been referring you all of their post-surgical rehab patients, perhaps that surgeon would like to have your practice as a profit center under their own roof?

Or perhaps you are an acupuncturist specializing in fertility. If you have a great relationship with an OB/Gyn who specializes in fertility, perhaps s/he would like to have your practice as part of their offerings.

Approaching a colleague, referral source, or competitor can be touchy. If a good referral source finds out you are leaving, they may redirect their referrals. And you don’t want to give up too much information too quickly to someone who could use that information against you.

The same goes for employees who may think their days are numbered and start looking for an out. More on that in our posts about your first buyer call here.

First, no, we are not brokers. We work by the hour, on a project-by-project basis.

For many of you, by time you’ve gotten to this post, you have already tried using a broker. Many brokers are fine and do a good job, but by and large, we’re not huge fans for several reasons.

Generally, we just don’t feel they go the extra mile to get your practice sold. They work on commission, taking a percentage of your sale, so their vested interest is in getting your business sold, not at selling at the price you want. And beyond the fact that they take a non-refundable retainer up-front, some may also charge you beyond that whether or not they succeed in selling your practice.

Rather than go into all the details of how we feel, let’s present a case study.

One simple way to understand the difference between the way we help buyers and sellers and the way a broker works is to analyze the potential cost difference between a clinic selling for, say, $100k. Let's say you use a broker who asks for a relatively low retainer of $1,000 and a bargain-basement fee of 10% of your final gross sales price, payable upon signing a sales agreement with a buyer.

Let's also assume that you have a successful sale at $100,000. The broker may have put up to 15 total hours into your deal (putting your practice in the template listing on their website; using a sales agreement template for the contract; and talking you through some speed bumps).

In the end, the retainer is wrapped into the final fee you pay the broker. They get $10,000 (10% of your gross sale price) for 15 hours of work. That works out to roughly $666 per hour for them. Given that many brokers take much more than 10% (sometimes up to 30%), and many practices sell for much more than $100k, the hourly breakdown could go much higher.

Contrasting that same deal with the way we work:

If we're doing the whole deal, start-to-finish, from organizing a practice for sale to finding a buyer; from creating the sales contract to helping in the transition out of the practice, the average total cost in our experience comes to about $3,000. So in the example above, using us, you'd pay 70% less and get an additional 30+% of time and energy from us as well.

A lot more bang for a lot fewer bucks.

In fact, that's less than one-third the price for 30+% more hours spent on your deal.

Keep in mind that those numbers assume you're having us do a deal from start to finish. Many of our transactions involve having us do only a small portion of a deal, such as helping find a buyer, or create a sales contract. Note that a broker will only get involved if they get to participate in the entirety of the sales process.

There are many different methods one could use to sell a chiropractic practice. What we’ve summarized here are those that we feel are most appropriate and most effective in our experience.

While the five-step plan we outlined above works well, it also contains many micro-steps, such as the details of an Executive Summary; the technical aspects of creating a subdomain; and the art of demographically targeting a buyer, among other things.

We have done these things for our clients countless times, and feel we’re pretty good at it. If you would like to know more or need some help find a buyer for your practice, well… that’s our purpose in life. Let us know how we can help.

If you are ready for the next step, evaluating a potential buyer, click here.

In the process of selling a chiropractic practice, so much time and energy is used trying to find a buyer that you may overlook preparing for the moment when you begin getting calls or emails from someone who is interested in getting more information.

While a lot of people choose to just wing it on their first calls, we prefer to hew close to that old saying that luck happens when preparation meets opportunity. The opportunity is borne out of your marketing of the practice, whether online, through snail mail, or word of mouth.

And while we do a lot of work for people to create those opportunities through our marketing campaigns here at Sellingapractice.com, this post is more about some simple steps, a roadmap of sorts, to prepare you in speaking to a potential buyer.

What follows are five important steps to consider when preparing to sell your practice, before you talk to a potential buyer for the first time.

Before you start talking details, you need to be prepared with a non-disclosure agreement (NDA). There are many different levels of “security” in an NDA, and we’re happy to create one for you that you can use with your potential buyers.

It may seem awkward to ask a stranger to sign an NDA, but it is common practice when selling a business of any kind.

Your practice is valuable, and asking for an NDA is further proof of that. The easiest way to do so is to tell the potential buyer that you would like to email them an NDA, and make an appointment thereafter for a time to talk on the phone or in person.

If someone refuses to sign an NDA, you don’t want him or her to be your buyer. Plenty more important signed documents will be coming after that NDA if you’re to have a successful sale, so anyone who shies away from it is…someone you should shy away from.

Once you are talking to someone (likely on the phone first), be sure to ask a lot of questions about them, their goals, what they want their lives to look like.

You're not just being interviewed; you're interviewing them so you don't waste time with the wrong person.

Assuming they sound ok on the phone, you may wish to ask if/when they might like to come up and spend a day shadowing you (or perhaps half a day). One or two days max. That should be enough to give them a sense of how you do things before you take it to the next level.

Let them know you have other potential buyers, and you’d like to be in contract by a certain date, perhaps a month out. A time constraint is important so that you’re not left hanging waiting for a potential buyer who may not come through—time perhaps better spent looking for more buyers!

This is a standard report that most any financial tracking software, such as QuickBooks and the like, can easily spit out for you.

If you’re organized as a corporation, it will be a P & L for your corp. lf you’re a sole proprietorship, hopefully you’ve kept your books clean enough that you can create a P & L that’s specific only to your business. We recommend you do this before your marketing begins so you’re prepared.

The P & L lets the potential buyer get a glimpse into how your business is run, see any efficiencies you have created, check out a (hopefully) ever-increasing bottom line, and look for things they could do to make even more money if they take over.

A serious buyer will ultimately want to see more than just this year's P & L, regardless of your situation. I think 3 years is reasonable, but in the beginning, going a year back, or providing just the current year if you are at least 6 months into the year, should be sufficient. Expenses change over time, and a potential buyer needs to see current expenses so they get a sense of what they could expect if and when they take over.

We often find that sellers are hesitant to print a P & L, as it’s quite a vulnerable experience to show it to a potential buyer. Further, many of the categories in the report may not make sense to a buyer.

We have specific tools and techniques we employ when we work with clients to make this part of the experience go as smoothly and easily as possible. Let us know if you’d like some advice on this stuff.

In addition to your P & Ls, a serious buyer will want to see how you were taxed, and square your tax returns you’re your P & Ls. Three years of returns is a reasonable request, and with more complex sales, we’ve seen buyers request five or even seven years.

Just as we said above regarding your entity (corporation vs. sole proprietorship), a corporate entity should only need to provide corporate returns.

A sole proprietor may be uncomfortable giving out their personal tax returns, but the Schedule C should suffice.

I know this is titled “5 Steps…”, but an important sixth step is to have prepared an Executive Summary that you can show to a potential buyer.

An Executive Summary is like a very short (1-2 page) business plan that lays out all the important details about your practice: revenues, price, justification, and potential future growth.

We have a formula we use to create these and would be happy to help you do so. We use them on websites, in advertising materials, as well as in simple PDF form to send to potential buyers. We wrote a whole post on Executive Summaries, which you can find here.

Know that you won’t usually share your financial information with a potential buyer until they’ve signed an NDA; they have come to shadow you or meet you in the office; and they have continued to show interest. It’s best to have the financial documents password-protected and in a format that you can e-mail potential buyers as needed.

Being prepared in advance for your first interaction with a potential buyer will save you from experiencing a lot of time, energy, and needless anxiety later on when the phone starts ringing and the emails begin to arrive. Once you have these bases covered, you should feel a lot more free and open about your practice, and spend more quality time figuring out if your potential buyer is someone with whom you’d like to move forward in the process.

And of course, if you need any further help or advice about selling your practice, we’re here to help. Reach out to us and we’d be happy to get on a call and focus on your needs. Contact us below.

Your purchase contract needs to reflect the uniqueness of your practice. Asset or Entity sale? How much will be paid up-front? What about employees? Learn some of the key questions to ask in order to create a contract that's right for you.

Get These Big-Picture Questions Answered Before You Start on the Fine Print

Creating a sales contract is a complex process that requires the answers to many important questions. So rather than just showing you what a contract can and should look like (which is basically impossible given that each deal is unique), we’ll instead go over many of the most important considerations that need to be dealt with in order to put together a solid contract for the sale of a chiropractic practice.

In the bigger picture of selling a chiropractic practice, the following issues will need to be thought through and likely negotiated by both the buyer and the seller before you can even consider putting together a contract.

With few exceptions, you will either be selling your corporate entity (S-Corp, C-Corp, LLC, etc.), or you will be selling the assets of your practice. Thus, you are either doing an Asset Sale, or an Entity Sale.

The assets consist of tangible assets such as furniture, fixtures and the like; and intangible assets, such as intellectual property and goodwill.

If you are selling the parts that make the practice run, the assets, but perhaps retaining your company name or some parts of the business, you will likely do an “Asset Sale.”

If you are a sole proprietor, you will be doing an Asset Sale, though practices set up as corporations can also do Asset Sales and keep their corporate name after the deal is done, or choose to simply dissolve the corporate post-sale.

If you are selling the company, this is usually referred to as an “Entity Sale.” You are selling the business entity itself.

There are big advantages and disadvantages to each kind of sale, depending on your individual situation. These usually boil down to questions of legal liability and how taxes are calculated, so we highly recommend you get the advice of a trusted accountant and attorney when it comes to answering the questions inherent in the form your sale takes.

Whether you are considering buying or selling a chiropractic practice, we are also happy to help you think through some of the legal and tax questions inherent in this decision.

When asked the question of whether the seller of a chiropractic practice prefers to be paid up-front or over time, most would of course prefer to be paid the full balance as soon as the papers are signed.

But like most large purchases, such as cars and homes, the reality is that you will most likely arrange to have some part of it paid upfront as a sort of down payment, and the rest paid over time in installments.

And unlike buying a car or a house, which are both arm's-length transactions with guarantees made by manufacturers and possibly involving middle-men or women (escrow agents), the sale and transfer of a chiropractic practice is something that requires trust between the parties and will take time. Time to transition patients and employees and leases and utilities, and time to minimize attrition.

(We have whole posts dedicated to these subjects. Click here for more on those.)

Among our many recommendations for buyers is that they get as much of the payment up-front as possible. We have many other suggestions we’d be happy to talk about when it comes to payment structures, and we go into further detail on the details here.

In the end, the way that the practice is paid off will be a significant defining quality of the final sales agreement.

As I write this, we are in the process of finalizing a deal for a very large practice in the Pacific Northwest. The sale involves both the sale of a chiropractic practice, as well as the building it is housed in, and the practice has several key, loyal, long-term employees who play important roles in keeping the practice profitable.

If you are buying a practice that has loyal, competent employees, an important question will be whether you want to keep those employees, or start anew with your own.

Selling a chiropractic practice may necessitate keeping employees, perhaps incentivizing them to work for your successor as part of a smooth sale. Like all of the other questions outlined here, the answers to these questions will form an important part of your sales contract.

If you're not sure what to do about employees, check out our special article on that subject here.

Related to the question above, the buyer of a chiropractic practice may wish to have the seller stay on for a while as an employee or consultant for a given length of time.

There are several considerations here, from the timeline during which the seller stays (months, years?), to the reasons why (help smooth the transition, pacify patients and assure employees).

Depending upon the situation, the seller may want to get out ASAP, or, perhaps in the case of a larger entity like a hospital taking over a smaller practice, the buyer (the hospital) may want the seller (the practitioner) to stay for a while.

Most chiropractors who have developed a solid practice will have a consistent stable of patients with whom they have created exceptional relationships. As practitioners, we know that our return patients form the backbone of our clinics, providing us with everything from word-of-mouth marketing to financial stability to the very pleasure we get out of the practice of medicine itself.

So when it comes time to sell the practice, if you’re not staying with the newly owners as an employee, will you want to keep practicing? And if so, where?

Most shrewd buyers are aware that your popularity as a practitioner is part of the value of your practice, and it’s a reasonable assumption that they will want to have signed an agreement not to compete to preserve their investment. These agreements (covered in more detail in this post)

usually specify both a distance and length of time during which the seller will not compete with the practice they just sold.

These agreements also have a value when tax time arrives, so be sure to check with your accountant to see how you can allocate the value of the non-compete as part of your deal.

Of course, there are many other considerations when it comes time to buy or sell a chiropractic practice, but we find that most are subsets of the five big-picture items we discuss in this post.

We recommend that you address these issues as early on in the process of buying or selling a practice as possible—even before you have an interested party on the other side. Having done so will help organize your thinking and get you ready to negotiate the finer points that lead to a successful, signed agreement, and a sale that closes.

This post focuses on creating a the big questions you need to ask before settling down to write a contract. Each of the big-picture subjects covered herein have many smaller steps to them, and we have written articles related to many aspects of the process. Check out some of the following free resources here on our website:

There are usually only two structures that the sale of a practice can take: selling some or all of the assets (an asset sale), or selling the actual corporate entity (Corp, LLC, LLP, etc.), an entity sale.

If you are a sole proprietor, not incorporated, your only choice is to do an asset sale, as you have no corporate entity to sell.

That said, a corporate entity such as an S-Corp or LLC can sell its assets and do an asset sale between it and an individual or another company.

If you’re considering buying or selling a chiropractic practice and want to know which type of sale is most appropriate for you, it’s important that you (1) understand what assets are; (2) how liability pertains to each kind of sale; and (3) get to know the tax consequences of an asset vs. entity sale.

Whether you are selling your company (an entity sale), or are a sole proprietor or company selling the assets of your company (an asset sale), the value of almost any chiropractic practice boils down to its assets. Let’s go into a bit more details about how assets are classified.

This is the stuff in the office. The furniture, fixtures, chiropractic equipment. Even the decorations, books, chairs in the waiting room. Whatever objects and equipment the seller intends to let go as part of the sale of their chiropractic practice. When it comes time to sell, a seller will quite literally need to go through the whole office(s) and itemize the estimated value of everything.

These are the highly valued parts of the business that are not so easily quantifiable but are quite important, such as any intellectual property associated with the business (copyrights, trademarks, websites, web domains, etc.), as well as the value of the business name, address and assignability of the lease, retained employees, contracts with insurance companies, and other goodwill. In fact, when you hear the term, “Goodwill,” it is often just a simple word used to cover many of the intangible assets that lie outside of easily identified intellectual property. This is also part of what makes the practice continue to grow over time, it’s reputation. (If this is still confusing, we’d be happy to explain it in more detail over the phone or through email.)

Liability is loosely translated as any kind of legal claims or debts owed by the practice. The degree to which the buyer of a chiropractic practice takes on the liabilities of a practice depends to a large extent upon what type of sale you are doing.

Because a corporate entity shields its owner(s) from personal liability, any liabilities are liabilities of the corporation itself, and thus usually transfer over to the new owner in the sale of a chiropractic practice.

In short, the company being bought will need to resolve its claims and debts regardless of who is behind the corporate veil (regardless of who owns it).

Because of this, a buyer who is interested in buying the corporate entity will want to know all liabilities ahead of time.

Buyers may also ask that the sales contract include provisions that all known debts are paid down or paid off before closing.

And because a company may later be sued for actions taken before the entity was sold to a new owner, many potential buyers of a practice will ask that the sales contract include a provision that the seller be responsible for any claims related to any undisclosed or unexpected liabilities that may show up after closing related to issues that started before closing.

If the buyer of a chiropractic practice feels that the valuation (price) of the practice is too high relative to its liabilities, they may use the liabilities as a negotiating tool to lower the valuation of the practice and buy it for less.

(For more on valuation / valuing a medical practice, see our big post on the subject here.)

In the vast majority of cases, liability does not follow an asset.

Further, part of any good sales contract will contain a provision that all assets are in good working order before the sale to the best of the seller’s knowledge.

For example, if you possess an asset, such as a couch in your waiting room, and you sell it, you would not normally be held liable for the injuries or issues created by the couch once it is owned by a new party.

As my wife (an attorney) is fond of saying, anything can be litigated. But, alas, this is considered quite rare.

And when a sole proprietor or company sells its assets (but not the actual company), the new owner is not held responsible for any existing debts or claims related to the practice, except as written into the sales contract.

Another major consideration when choosing how you will organize your sale is to know something about the tax consequences of each kind of sale.

Okay, let’s keep it simple…

Most of us know that ordinary income tax rates can vary and go north of 35% depending upon your individual tax situation. The long-term capital gains rate tends to hover around 15%.

Long-term capital gains are taxed at more favorable rates than ordinary income. The current long-term capital gains tax rates are 0%, 15%, and 20%, while the rates for ordinary income range from 10% to 39.6%.

Most of us of course would prefer to be taxed at as low a rate as possible, and most entity sales will be taxed at the long-term capital gains rate.

In contrast, in an asset sale, at least some of the assets will be taxed at ordinary income tax rates. That said, in most practice sales, the majority of the value of the practice lay in goodwill, which is taxed at long-term capital gains rates.

In the first example, an entity sale, the stock of the company is trading hands, and the gain is like a long-term stock gain for the sellers (long-term capital gains rate).

In an asset sale of a chiropractic practice, let’s say you, the seller, have made a list of all the furniture and fixtures that are part of the sale. You bought that couch in the waiting room for $1,000, depreciated it over the last five years on your tax returns, and then valued it at $200 on your list of assets when you sold the practice. The difference between the value of the fully depreciated asset ($0) and the sale price ($200) is taxable at ordinary income tax rates. Multiply that out over all your fixed assets, and you can see where this can lead.

It should be noted that goodwill and other intangibles such as intellectual property may be taxed differently (in fact, more favorably) for a buyer. For this reason, during negotiations, a seller will want to minimize the value of tangible assets and amplify the goodwill, while the buyer will seek to do the opposite.

Another consideration for C-Corp sellers: While above I wrote that one corporation can sell its assets to another, if the seller is organized as a C-Corp, doing an asset sale exposes the shareholders to the specter of double-taxation. Whereas, if the entity is sold in its entirety, the sale of the stock of the corporation results in only one tax bill.

-Sell all assets of a chiropractic practice.

-Only choice for sole proprietors.

-Can be done as an individual or as a corporate entity.

-Liability for assets only.

-May be easier to deal with for smaller businesses tax-wise.

-Overall, may be more advantageous for both parties, as they can negotiate the value of each asset class with one another for tax purposes.

-Sale of entire corporate entity (S- or C-Corp, LLC, etc.).

-Can only be done entity-to-entity, no sole proprietors.

-Liabilities carry over to new owner unless exceptions are made.

-May be more advantageous for seller liability-wise. Less so for a buyer, who may be taking on the liabilities (risks) of the corporate entity they are purchasing.

The key is in how you frame it.

In entity sale, even if the buyer is able to have some exceptions made in the sales contract to accepting certain liabilities, they are accepting all others.

In an asset sale, it’s kind of the opposite: a buyer can pick and choose which assets they want and which they don’t, likely cherry-picking the most valuable assets and leaving the others behind. They will probably have zero liabilities related to the assets they acquire, and will receive a more favorable tax treatment from an asset sale, getting write off big parts of the sale once it’s over.

Given the points covered above, the bottom line is that a corporate entity with no liabilities will most likely want to sell the whole entity, while an asset sale may be more advantageous for both parties, as they can negotiate the value of each asset class with one another for tax purposes. This is why we usually recommend most clinics do an asset sale.

And if the seller is a sole proprietor, there’s no choice: it will be an asset sale.

It is important that you consult a CPA before making a final decision on how you transfer the business. The advice we give here is based on our knowledge and experience, but we’re not CPAs, and we want you to know that.

If you’re still wrestling with what kind of sale would be best for your individual situation, we’d be happy to discuss the pros and cons with you. Reach out to us. The first call is free.

A major consideration when choosing how you will organize your sale is to know something about the tax consequences of each kind of sale. We generally talk about Asset Sales versus Entity Sales, and we've written a bunch about the differences between the two in other posts. (See this one if you don't know the difference.)

Assuming you do know the difference, let's jump in and let’s keep it simple…

Most of us know that ordinary income tax rates can vary and go north of 35% depending upon your individual tax situation. The long-term capital gains rate tends to hover around 15%.

Long-term capital gains are taxed at more favorable rates than ordinary income. The current long-term capital gains tax rates are 0%, 15%, and 20%, while the rates for ordinary income range from 10% to 39.6%.

Most of us of course would prefer to be taxed at as low a rate as possible, and most entity sales will be taxed at the long-term capital gains rate.

Most entity sales will be taxed at the long-term capital gains rate.

In contrast, in an asset sale, at least some of the assets will be taxed at ordinary income tax rates. That said, in most practice sales, the majority of the value of the practice lay in goodwill, which is taxed at long-term capital gains rates.

In the first example, an entity sale, the stock of the company is trading hands, and the gain is like a long-term stock gain for the sellers (long-term capital gains rate).

In an asset sale of a chiropractic practice, let’s say you, the seller, have made a list of all the furniture and fixtures that are part of the sale. You bought that couch in the waiting room for $1,000, depreciated it over the last five years on your tax returns, and then valued it at $200 on your list of assets when you sold the practice. The difference between the value of the fully depreciated asset ($0) and the sale price ($200) is taxable at ordinary income tax rates. Multiply that out over all your fixed assets, and you can see where this can lead.

It should be noted that goodwill and other intangibles such as intellectual property may be taxed differently (in fact, more favorably) for a buyer.

For this reason, during negotiations, a seller will want to minimize the value of tangible assets and amplify the goodwill, while the buyer will seek to do the opposite. (Check out this link for more on the details of goodwill in a medical practice.)

As inferred above, for tax purposes, asset sales can be broken down into different asset classes such as goodwill, tangible assets, intangibles like intellectual property, non-competition agreements and the like. The way that the total purchase price is allocated among these categories, each of which is taxed differently by the IRS, can be a major point of negotiation between a buyer and seller.

Once both parties have agreed and the sales contract is signed, a section in the agreement will need to spell out the allocations. Both the buyer's and the seller's accountants will then look at the allocations agreed to in order to file Form 8594, the Asset Allocation Statement. The IRS will expect the allocations to appear the same on the buyer's and the seller's tax returns!

For more on how different kinds of asset classes are taxed, of course you will need the help of a CPA. We also highly recommend you check out this whitepaper from Raymond James.

-Sell all assets of a chiropractic practice.

-Only choice for sole proprietors.

-Can be done as an individual or as a corporate entity.

-Liability for assets only.

-May be easier to deal with for smaller businesses tax-wise.

-Overall, may be more advantageous for both parties, as they can negotiate the value of each asset class with one another for tax purposes.

-Sale of entire corporate entity (S- or C-Corp, LLC, etc.).

-Can only be done entity-to-entity, no sole proprietors.

-Liabilities carry over to new owner unless exceptions are made.

-May be more advantageous for seller liability-wise. Less so for a buyer, who may be taking on the liabilities (risks) of the corporate entity they are purchasing.

The key is in how you frame it.

While one corporation can sell its assets to another, if the seller is organized as a C-corp, doing an asset sale exposes the shareholders to the specter of double-taxation. Whereas, if the entity is sold in its entirety, the sale of the stock of the corporation results in only one tax bill. And In an entity sale, even if the buyer is able to have some exceptions made in the sales contract to accepting certain liabilities, they are accepting all others.

In an asset sale, it’s kind of the opposite: a buyer can pick and choose which assets they want and which they don’t, likely cherry-picking the most valuable assets and leaving the others behind. They will probably have zero liabilities related to the assets they acquire, and will receive a more favorable tax treatment from an asset sale, getting write off big parts of the sale once it’s over.

Given the points covered above, the bottom line is that a corporate entity with no liabilities will most likely want to sell the whole entity, while an asset sale may be more advantageous for both parties, as they can negotiate the value of each asset class with one another for tax purposes. This is why we usually recommend most clinics do an asset sale.

And if the seller is a sole proprietor, there’s no choice: it will be an asset sale.

It is important that you consult a CPA before making a final decision on how you transfer the business. The advice we give here is based on our knowledge and experience, but we’re not CPAs, and we want you to know that.

If you’re still wrestling with what kind of sale would be best for your individual situation, we’d be happy to discuss the pros and cons with you. Reach out to us. The first call is free.

When it comes to selling a chiropractic practice, there are basically two different kinds of payment arrangements: Lump Sum Payments and Installments.

In most cases, the two are mixed in some fashion.

There are also earn-out and stock swap deals, which we’ll touch on at the end of this article, but let’s stick to what’s most common for now.

A lump sum payment, in the purest form, means that the buyer is paying for the whole cost, the whole price of the business, all at once at closing.

For most sellers, this is the dream scenario, not having to be concerned about getting the full payout for the business over time. Getting paid all of the total up-front is so desirable that, if your buyer is even considering it, the allure may be incentive enough to reduce the total price of the practice in exchange for getting the money all at once.

A more common and more realistic expectation for most of us is that the buyer will pay a down-payment due at closing in the form of an account transfer or cashier’s check, and pay the rest in installments, with interest, over time.

Regardless of the situation, the truth is that installment payments are inherently risky, as, until you have all of the money in-hand, there always exists the risk that the buyer could walk away before the payment period is over.

In order to balance the risks of installment payments, there are many things you can consider doing before the sale and as part of your sales contract. What follows are some of our most important recommendations.

If the buyer of your practice is a corporate entity (LLC, S-Corp, C-Corp, etc.), it may be that their corporation was just formed to buy your practice or otherwise doesn’t have a lot of resources or history behind it. In this situation, in addition to having the corporate officer signing the installment agreement in your sales contract, you should also have it personally guaranteed (signed) by the individual seller. In many instances, this is the same person, but it would show up on the contract as two separate signature lines.

This is what any lender would normally do, and you should as well. A credit report will allow you to get a sense of someone’s history of paying their debts, and will give you a snapshot of what your future may look like when you’re holding the bag. Say no to anyone with a funky credit history!

For more on how to obtain someone’s credit report, check out this simple article.

Get personal financial statements and/or the last few months of bank statements to prove that the buyer not only has the funds to pay the down payment, but also has reserves to keep them and their family in the black after the sale.

If the buyer doesn’t have a lot of assets to back them up, you may wish to have them find a third-party. This is also something banks frequently do, get a co-borrower. In this case it may be someone with a lot more assets, such as a parent or relative, a spouse, or even a friend. Someone who is willing to sign on the dotted line such that, if your buyer defaults, the third-party’s ass(ets) are on the line.

One note here: Just as you are checking out the credit and financial history of the buyer, you should also obtain a credit report and financial statement from the guarantor.

This means the buyer doesn’t really own the business until all payments are made. In the mean time, if they default in their payments, you can have it written into your sales agreement that you can repossess the practice if they fail to pay. You see this all the time when financing a car or a house: If you fail to pay, the bank can repossess the asset, even if you’ve paid off 90% of it.

A sample UCC statement. Easy to find if you Google "UCC".

To make the repo option legally binding, most states will have you file a Uniform Commercial Code (UCC) financing statement with the Secretary of State. Check your Secretary of State’s website page for details on how to get and file a UCC in your state.

Putting this clause in your Promissory Note (the part of your sales contract that relates to the installment payments) means that, if the buyer does not make a payment (or a certain number of payments) on time, the whole unpaid balance of the Note is immediately due. This should help motivate a buyer to keep abreast of their payment responsibilities, especially if you have also taken the precautions listed above.

You can also add a clause to your Promissory Note that, if they fail to pay, the cost of your needing to collect from them (including collection agents, attorneys’ fees, etc.) falls on them. Though of course, if they have no more assets and that’s why they stopped paying, you may still be stuck with a bill!

The larger the down payment, the less the remaining monthly payments will be, and the more commitment the buyer is showing to purchase the practice.

You’re not getting the full use of the financial value of your practice as long as it is being paid off, so it makes sense that you would charge interest.

You should charge interest regardless of whom you are selling to, even family. This also makes the buyer more motivated to pay you earlier to avoid interest.

The amount of each payment, with interest, is simply the amount remaining after the down payment + interest.

Amortization calculators are available online to help you out with this. Check this one out.

Two to three years is preferable. The longer the payment period, the higher the risk. That said, it needs to be realistic for the buyer such that their profits will easily be able to accommodate that monthly payment.

If the buyer wants to pay you out early, more power to them (and you)! Again, less risk, more up-front reward.

Make the first payment due one or two months after they’ve taken over the business so they have some time to gather financial momentum.

This strategy can also be a card you hold in the pre-sale contract negotiations. They want something from you, and you may refuse or reduce their demand in exchange for the opportunity to have their first payments due a few months after they start running the business.

This is when a buyer with little money offers to pay the seller back for the price of the practice over time as they earn money, based on their volume in most cases. We see this a lot with small acupuncture practices and sellers who are desperate to sell. They’ll take a small down payment and then, say, $30 per patient seen per month.

There are a couple of problems inherent in these types of arrangements. They include:

1. Trust. As a buyer you have to trust that the amount of patient visits you are being paid for are accurate.

2. The buyer may fly the practice into the ground. No patients means no earn-out.

The only conditions under which we’d be ok with an earn-out arrangement would be if you were still running the business until it’s paid off; you get additional money if the business grows; and you’re getting a great price for the practice.

Otherwise…well, we don’t recommend these arrangements unless you’re a desperate seller and you have no other time or options.