Financial statement analysis is the process of examining a company’s financial statements for decision-making purposes. External stakeholders utilize it to understand the overall health of an organization as well as to assess financial performance and business value. Have a look at the financial statements analysis templates provided down below and choose the one that best suits your purpose.

There are commonly six steps to developing an effective analysis of financial statements which are as follows-

1. Identify the industry’s economic characteristics

First, define a value chain analysis for the industry which means the chain of activities associated with the creation, manufacture, and distribution of the firm’s products and/or services. Techniques such as Porter’s Five Forces or outline of economic attributes are typically used in this step.

2. Identify company strategies

Secondly, examine the character of the product/service being instructed by the firm, as well as the distinctiveness of product, level of profit margins, creation of brand name loyalty and management of prices. Additionally, factors such as supply chain combination, geographic diversification, and industry diversification should be granted.

3. Evaluate the quality of the firm’s financial statements

Study the critical financial statements within the context of the relevant accounting standards. In analyzing balance sheet accounts, problems such as recognition, valuation, and classification are keys to proper evaluation. The main question ought to be whether or not this record may be a complete illustration of the firm’s economic position. When assessing the income statement, the foremost point is to properly estimate the quality of earnings as a complete representation of the firm’s economic performance. Evaluation of the statement of stock flows assists in knowing the influence of the firm’s liquidity position from its operations, investments and financial activities over the period that is in essence, where funds came from, where they went, and how the overall liquidity of the firm was hit.

4. Analyze current profitability and risk

This is the step where financial professionals can actually add value to the evaluation of the firm and its financial statements. The most well-known analysis tools comprise key plan ratios regarding liquidity, asset management, profitability, debt management/coverage, and risk/market valuation. With the regard to profitableness, there are 2 general inquiries to be asked: in what profitable are the operations of the firm relative to its assets—independent of wherewith the firm finances those assets, and how effective is the firm from the aspect of the equity shareholders. It is also necessary to learn how to disaggregate return measures into primary impact factors. Lastly, it is important to examine any financial statement ratios in a comparative manner, looking at the current ratios in relation to those from earlier periods or relative to other firms or industry norms.

5. Prepare forecasted financial statements

Although frequently challenging, financial professionals must make reasonable suppositions about the future of the firm (and its industry) and decide how these suppositions will affect both the cash flows and the funding. This frequently takes the form of Pro-forma financial statements, based on methods such as the percent of sales strategy.

6. Value the firm

While there are several valuation approaches, the most common is a type of discounted cash flow methodology.

This money flows may well be within the variety of projected dividends, or more detailed techniques such as free cash flows to either the equity holders or on an enterprise basis. Other approaches might embrace exploitation relative valuation or accounting-based measures like measure additional.

Download the high-quality Financial Statement Analysis template to help you understand the financial health of your company that would be vital to its development. This ready-made file is designed to help users review and analyze their company’s financial statements to make better economic decisions. These statements include your company’s income statement, balance sheet, statement of cash flows, as well as the statement of changes in equity among others. The financial analysis sample file is professionally designed with content users can fully customize to better suit their preferences. Download now!

ohiodominican.edu

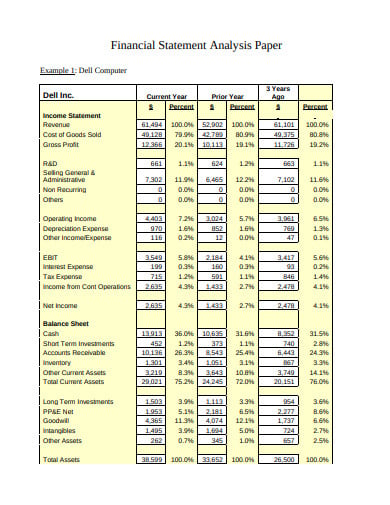

File FormatFinancial analysis may be a paper that contains the small print of the company’s money health. Even though the firm’s history, monetary statements, and stock performance will summarize varied aspects of its monetary performance, the monetary analysis paper incorporates all the information into a comprehensive kind. Check out the free analysis template example provided here.

sieds.it

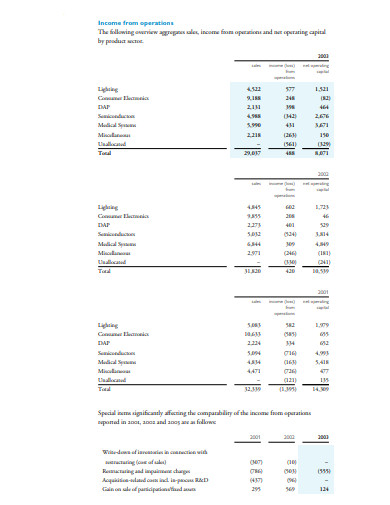

File FormatA sample on Financial Statement Analysis in Mergers and Acquisitions has been provided here. This paper can discuss the sensible applications of monetary statement analysis usually performed by company acquirers in open market valuation and evaluation exercises. This paper isn’t meant to be an associate comprehensive discussion, and some of the items discussed may not be applicable in a given situation. Every open market dealing is exclusive, and judgment is needed to see the acceptable nature and level of monetary statement analysis that ought to be undertaken in every case. Give it a read to make your work hassle-free.

newhorizonindia.edu

File FormatThe budget analysis is very important because it provides substantive data to the shareholders in taking such choices. The budget analysis is very important to them as a result of they will get helpful data for his or her investment decision-making functions. Learn all about the Meaning of Analysis of Financial Statements and everything related to it.

mercercapital.com

File FormatIn this document, you will get details on the Basics of Financial Statement Analysis which you can refer to. It is a guide for private company directors and shareholders. Go through it now.

philips.com

File Format

nyu.edu

File Format

miga.org

File Format

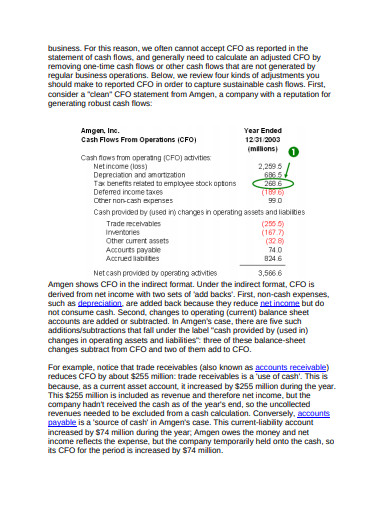

i.investopedia.com

File Format

sieds.it

File Format of financial sector template" width="390" height="505" />

of financial sector template" width="390" height="505" />

sbp.org.pk

File Format

hrsbdc.org

File FormatFinancial statement analysis involves gaining an understanding of an organization’s financial situation by reviewing its financial reports. The results can be used to make investment and lending decisions. This review involves identifying the following items for a company’s financial statements over a series of reporting periods like trends and proportion analysis.